Will AMC keep going up?

Let’s start with the big story from Tuesday: AMC

AMC popped 22% on Tuesday, breaking above $30 again.

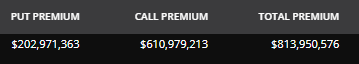

AMC options were incredibly active again, just like they were last week. AMC was the fourth-most traded name in the options market in terms of total premium traded. Total premium was $813 million for AMC Tuesday (the highest in the market was SPX at $1.7 billion).

Here is how that option premium broke out, according to the Options Matrix.

The most active call was the $35 expiring this Friday (June 4th). It’s no surprise that AMC bulls are looking to the out-of-the-money calls to profit from AMC’s rise. Right now, we are seeing a smaller-scale version of the GameStop squeeze from January in which every single OTM call printed money for days on end.

Will AMC keep going up?

Nobody knows for sure, especially with these huge short squeeze rallies. GameStop went up several hundred percent after most “experts” were certain the stock had exhausted itself.

While it’s impossible to tell for certain what’s coming next, I think the best strategy is to look at the option flow for clues. The option flow doesn’t always tell you where a stock is going, but in some cases it can give you a great clue.

For example, we noticed that AMC’s option flow hinted at a huge rally all the way back on May 11.

Option activity has died down a bit compared to Thursday and Friday of last week, but volume remains high. Total option premium traded in AMC last week was well over $1 billion on multiple days, so it’s notable that option activity has fallen considerably since then.

The put/call ratio is still very low at 0.36, which is normally a bullish sign. However, things change a bit after a large rally. Call volume was extremely high last week, meaning there are large amounts of call options still outstanding.

Therefore, high call volume after a large run-up isn’t as bullish as large call volume when the stock is doing nothing. A lot of the activity could be call holders unloading positions at increasingly-lower prices.

This isn’t a certainty in this situation, but it’s a scenario to keep in mind.

To figure out if that’s actually happening here, I checked the prices of weekly calls. If prices of those calls fell during the day, the scenario I described above could be happening. In other words, it would mean that the high call volume is actually call holders trying to unload their calls at lower and lower prices, which would actually be bearish.

Here is the chart for the $40 calls expiring Friday, which are actually pretty close to in-the-money based on Tuesday’s after-hours trading.

The calls fell off after Friday’s peak IV levels, but the prices have remained fairly steady since that decline. This doesn’t give me much of a bearish or bullish signal, so I will keep digging until I find something that informs my opinion either positively or negatively.

Speaking of which, I urge AMC traders (and traders of any other stocks) to follow a similar process. Far too many people will remain bullish long after it makes sense to do so. That’s how people convince themselves to buy GameStop at $450 and end up losing 50%.

You should not be bullish forever, especially after a 5,000% run-up in a few months. Rallies like that can’t be sustained without a sharp drop on the other side as people take profits. If you’re a short-term trader, you should have a process for looking at option data, the trade tape, and sentiment to inform your outlook on the stock.

Now back to my AMC analysis.

IV is getting crushed over the past few days. Even though AMC is up since Friday afternoon, the calls are in the same spot. This tells me not to buy calls, as I’ll likely end up losing money even if AMC continues to rise steadily. To pump IV again, AMC would likely need a massive up move that defies most people’s expectations.

Based on the mixed options data right now, I’m not buying AMC options. I think there is still money to be made selling calls, but a name like AMC can easily wipe out call sellers. I think the only play here is to own shares or sell spreads.

I also think looking at other movie theater stocks is a good play. The rising tide of AMC will likely lift the other boats.

Subscribe to our investing newsletter and get 3 new ideas 3x a week: Alpha Letter