Let’s cover some stocks with high implied volatility (IV). When trading options, I usually want options with high IV, but within reason.

If a call has an IV of 400%, it could be too risky to get involved. Such a high IV implies that the market is expecting a huge move, so if I buy options or shares I may lose out if the eventual move isn’t huge.

However, I could also lose big by selling the volatility if the stock or options move against me. With stocks like AMC and GameStop, we’ve seen that anything can happen.

That’s why I pull up stocks with IV levels around 100% using Vig. They offer the following two scans, among others:

I usually start with Code Yellow since I don’t want options with the highest IV levels.

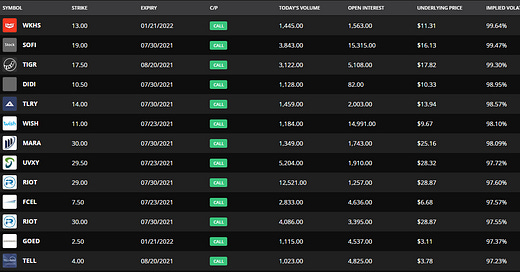

Here’s what shows up in the scan right now:

There are a few different directions I could go with this data.

The first is covered calls. If I like any of these stocks for long-term holds, I could either sell calls against shares I already own, or buy shares and sell covered calls.

Remember, the idea with covered calls is that you want IV to decrease in the short-term so that your short call trade works, but you can’t afford to buy shares in a company that will tank in the mid or long-term.

You can read more about this strategy in our new covered call newsletter here.

The next option I have is selling volatility.

When IV is high, it could be a good time to sell options and profit when IV decreases. I usually like to sell spikes in IV, meaning I want to sell calls just after a stock spikes. When I do this, I am selling calls to FOMO investors who rush in after the rally and pay high prices because they think the stock will keep going up.

Sometimes the stock does keep going up, but almost every rally is followed by a cool-off period as other traders take profits.

If you’re curious, here are the calls with the absolute highest IV today:

I like your newsletters but they seem to have stopped for the last month. Is this newsletter dead?