GameStop IV Above 400% - What's the Trade?

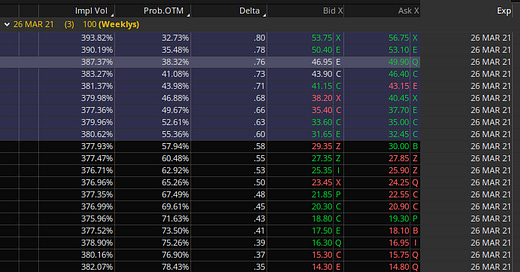

GameStop’s implied volatility (IV) is through the roof. Near-the-money options expiring Friday have an IV near 400%. In comparison, the same options on Tesla stock have about a 60% IV.

What is IV?

It’s a complicated mathematical formula that basically tells you how volatile the option market is expecting the underlying stock to behave. GameStop’s IV is very high because traders know it could spike 100% in a couple of days or plummet 50%, which it has done several times over the last couple of months.

What’s the Trade?

In this newsletter, I will often tell readers to sell premium - meaning you want to sell options with high volatility. However, there are some cases where IV can be too high. With GameStop, you could sell a call that’s way out of the money now, but if GME goes up 100% you could have a crushing loss.

Let’s look at an example. Say you sell the $250 call expiring Friday for $12.25, or $1,225 total because 1 option contract represents 100 shares. You pocket $1,225, and if GameStop ends Friday below $250, you keep the entire amount.

You could also potentially buy the option back for cheaper to close out the trade early and lock in gains. Let’s say you sell the call and GameStop continues to drop; the option could fall to $6, or $600 total, and you could buy it back at that price. You’d then profit the difference of $625.

However, here’s why this trade is a bad idea: GameStop can easily move very quickly. If you don’t have some sort of hedge, you could lose your shirt.

Say that GameStop skyrockets 50% in the next couple of days, going from $190 to $285 by Friday at close. Your short call would be in the money by $35, meaning you would essentially owe $35 per share. $35 x 100 shares = $3,500. Offset this with the $1,225 in premium you received, and your loss would be $2,275.

For every $1 GameStop moves above $250, you would essentially lose $100.

And keep in mind, your “paper” loss could be much higher than $2,275 before expiration. The above scenario was only talking about the loss at the expiration of the contract.

If GameStop spikes 50% tomorrow, the call would be worth much more than $35. Every call is worth an Intrinsic Value ($35 in this case, because $285 - $250 = $35) + Time Value.

The time value is what someone is willing to pay for the chance that the stock will continue to go higher.

When you sold your call, the time value was $12.25 per share, because the call was out of the money. In other words, the call had no intrinsic value; a buyer was only paying for the time value based on the chance that GameStop could go up a lot more.

If the call ends up being worth $40 or $50, your broker could potentially stop you out and you wouldn’t be able to wait for GameStop to come back down to Earth.

My Trade

To answer the original question: I would not take a huge position in anything with GameStop options. If anything, you could sell 1 or 2 calls if you believe the GameStop rally is done for this week, but keep in mind your potential losses.

In this scenario, I would look to sell far out of the money (50% or more) calls just after an upward spike, and then close them out quickly for a 25% gain using a limit buy to cover order.

Typically, you want to sell premium on companies that have high IV, but not ones where massive rallies or corrections routinely happen.

Remember, it’s not a cheat code to sell extremely high-priced GameStop calls. The market is pricing those calls highly for a reason, and you could lose your shirt.